Quick Loans: Understanding, Types, Application, And Considerations

Quick loans are a vital financial tool in today’s fast-paced world, offering immediate relief in times of need. This comprehensive guide delves into the various aspects of quick loans, from their definition and types to the application process and essential considerations before taking the plunge. Dive in to explore the world of quick loans and make informed decisions for your financial well-being.

Overview of Quick Loans

Quick loans are a type of short-term borrowing that provides individuals with fast access to funds in times of financial need. These loans are typically processed quickly, with minimal documentation required, making them a convenient option for those facing urgent expenses.

Features of Quick Loans

- Fast approval process

- Minimal documentation

- Short repayment period

- High interest rates

Benefits and Drawbacks of Quick Loans

Quick loans offer the advantage of immediate access to funds, which can be crucial in emergencies such as medical bills or unexpected car repairs. However, the high interest rates associated with these loans can lead to increased debt if not repaid promptly.

Situations Where Quick Loans May Be Necessary

- Emergency medical expenses

- Home repairs after a natural disaster

- Unexpected car repairs

Types of Quick Loans

When it comes to quick loans, there are several types available to suit different financial needs and situations. Each type of quick loan has its own features, eligibility criteria, and repayment terms. Let’s explore some of the common types of quick loans below.

Payday Loans

Payday loans are short-term loans that are typically due on the borrower’s next payday. These loans are usually for small amounts and come with high interest rates. Borrowers often need to provide proof of income and have a checking account to qualify for a payday loan.

Installment Loans

Installment loans allow borrowers to repay the loan amount over a set period of time in regular installments. These loans are usually for larger amounts compared to payday loans and may have lower interest rates. Borrowers may need to have a certain credit score and income level to be eligible for an installment loan.

Title Loans

Title loans are secured loans that require borrowers to use their vehicle title as collateral. The loan amount is based on the value of the vehicle, and borrowers risk losing their vehicle if they default on the loan. Title loans typically come with high interest rates and short repayment terms.

Secured vs. Unsecured Quick Loans

Secured quick loans, like title loans, require collateral to secure the loan, reducing the risk for the lender. Unsecured quick loans, such as payday loans, do not require collateral but may have higher interest rates to compensate for the increased risk.

Eligibility Criteria

The eligibility criteria for quick loans vary depending on the type of loan. Common requirements include proof of income, a valid ID, a checking account, and a minimum credit score. Secured loans may have additional requirements related to the collateral being used.

Interest Rates and Repayment Terms

Interest rates and repayment terms for quick loans can vary widely depending on the lender, the type of loan, and the borrower’s creditworthiness. Payday loans typically have higher interest rates and shorter repayment terms compared to installment loans. It’s important to carefully review and compare the terms of different quick loan options before choosing one that best fits your financial needs.

Application Process

When applying for a quick loan, there are several steps you need to follow to ensure a smooth and efficient process. It’s important to be prepared with the necessary documentation and to understand how your credit score can impact the approval process. Here, we will discuss the general steps involved in applying for a quick loan, the documentation required, how credit scores may influence approval, and tips for expediting the application process.

General Steps for Applying for a Quick Loan

- Research and compare different lenders offering quick loans to find the best terms and interest rates.

- Fill out the online application form with accurate personal and financial information.

- Submit the required documentation, such as proof of income, identification, and bank statements.

- Wait for the lender to review your application and make a decision on approval.

- If approved, review and sign the loan agreement, understanding the terms and repayment schedule.

- Receive the funds in your bank account, usually within a few business days.

Documentation Required for a Quick Loan Application

- Proof of income (pay stubs, tax returns, bank statements).

- Identification (driver’s license, passport, or state ID).

- Proof of residency (utility bills, lease agreement).

- Additional documents may be required depending on the lender and loan amount.

Credit Scores and Approval Process for Quick Loans

- Your credit score plays a significant role in the approval process for quick loans.

- Lenders typically look at your credit score to assess your creditworthiness and determine the interest rate you qualify for.

- A higher credit score increases your chances of approval and may result in better loan terms.

- Even if you have a low credit score, some lenders offer quick loans for bad credit, but the interest rate may be higher.

Tips for Expediting the Application Process for Quick Loans

- Ensure all required documents are readily available before starting the application.

- Double-check the information provided in the application form to avoid errors or delays.

- Respond promptly to any requests for additional information from the lender.

- Consider applying during business hours for quicker processing times.

- Choose a lender with a streamlined online application process for faster approval.

Considerations Before Taking a Quick Loan

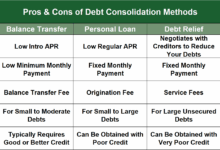

Before deciding to take out a quick loan, there are several important factors to consider. It’s crucial to weigh the pros and cons, explore alternatives, and fully understand the terms and conditions to make an informed decision. Additionally, being aware of potential pitfalls and how to avoid falling into a debt trap is essential for responsible borrowing.

Factors to Consider Before Opting for a Quick Loan

- Assess Your Financial Situation: Evaluate your current financial standing, income, expenses, and overall budget to determine if taking a quick loan is truly necessary.

- Understand the Costs: Quick loans often come with high-interest rates and fees. Calculate the total cost of borrowing to ensure you can afford to repay the loan without causing further financial strain.

- Consider Alternatives: Explore other options such as borrowing from family or friends, negotiating with creditors, or seeking assistance from non-profit credit counseling services before resorting to a quick loan.

Importance of Understanding the Terms and Conditions

Before signing any loan agreement, it is crucial to carefully read and understand all the terms and conditions. Pay close attention to the interest rate, repayment schedule, fees, and any penalties for late payments or defaults. Make sure you are comfortable with the terms before proceeding.

Tips to Avoid Falling into a Debt Trap

- Create a Repayment Plan: Develop a realistic repayment plan before taking out a quick loan to ensure you can meet the payments on time.

- Avoid Borrowing More Than You Need: Only borrow the amount you absolutely need to avoid accumulating unnecessary debt.

- Compare Lenders: Shop around and compare offers from different lenders to find the most favorable terms and rates.

- Be Wary of Predatory Lenders: Watch out for lenders who use aggressive tactics or offer loans with extremely high-interest rates that can trap you in a cycle of debt.

Final Summary

In conclusion, quick loans can be a double-edged sword, providing quick solutions while carrying potential risks. By understanding the nuances of quick loans and weighing your options carefully, you can navigate the financial landscape with confidence and security. Stay informed, stay empowered, and make the best choices for your financial future.