Consolidation Loans: Benefits, Risks, And Eligibility Criteria

Consolidation loans offer a strategic solution for managing multiple debts efficiently. From understanding how they work to exploring their advantages and potential drawbacks, this comprehensive guide delves into the world of consolidation loans.

Discover the key requirements for eligibility, different types of consolidation loans available, and the step-by-step process involved in securing these financial solutions.

What are Consolidation Loans?

Consolidation loans are financial products that combine multiple debts into a single loan, often with a lower interest rate. This can help simplify repayment by merging various monthly payments into one, making it easier to manage finances.

Consolidation loans work by paying off existing debts with the new loan, leaving the borrower with only one monthly payment to focus on. The new loan may have a longer repayment term, which can lower the monthly payment amount, providing some relief to the borrower.

Benefits of Consolidating Loans

- Lower Interest Rates: Consolidation loans often come with lower interest rates compared to credit cards or other high-interest debts.

- Simplified Repayment: Managing a single monthly payment is more convenient than juggling multiple payments.

- Reduced Stress: Eliminating the need to keep track of various due dates and amounts can reduce financial stress.

Types of Loans that can be Consolidated

- Credit Card Balances: High-interest credit card debts are commonly consolidated into a loan with a lower interest rate.

- Personal Loans: Multiple personal loans can be combined into one, streamlining repayment.

- Student Loans: Both federal and private student loans can be consolidated to simplify repayment.

Pros and Cons of Consolidation Loans

When considering consolidation loans, it is essential to weigh the advantages and disadvantages to make an informed decision about managing your finances effectively.

Advantages of Consolidation Loans

- Streamlined Payments: Consolidating multiple debts into one loan can simplify your finances by having a single monthly payment.

- Lower Interest Rates: Consolidation loans often come with lower interest rates compared to credit cards or other high-interest debts, potentially saving you money in the long run.

- Improved Credit Score: By paying off multiple debts with a consolidation loan, you can reduce your credit utilization ratio and improve your credit score over time.

- Fixed Repayment Terms: Consolidation loans typically come with fixed repayment terms, providing a clear timeline for becoming debt-free.

Drawbacks of Consolidation Loans

- Extended Repayment Period: While consolidation loans can lower monthly payments, extending the repayment period may result in paying more interest over time.

- Risk of Accumulating More Debt: Without addressing the root cause of debt accumulation, individuals may fall into the trap of accumulating new debts on top of the consolidation loan.

- Eligibility Criteria: Securing a consolidation loan may require a good credit score and stable income, making it challenging for some individuals to qualify.

Real-life Scenarios

Scenario 1: Jane consolidated her credit card debt into a single loan with a lower interest rate, saving her hundreds of dollars in interest payments each month.

Scenario 2: Mark took out a consolidation loan to pay off his debts but continued to use his credit cards, leading to a cycle of debt that left him in a worse financial situation.

Eligibility and Requirements

To qualify for a consolidation loan, individuals typically need to meet certain eligibility criteria set by lenders. These criteria may vary depending on the lender and the type of loan being offered. In general, applicants should have a stable income, a good credit score, and a manageable level of debt.

Typical Eligibility Criteria

- A minimum credit score requirement, often ranging from 600 to 700.

- A steady source of income to ensure the ability to repay the loan.

- A debt-to-income ratio within an acceptable range, usually below 50%.

- No recent history of bankruptcy or default on previous loans.

Documentation and Information Needed

- Proof of identity, such as a government-issued ID.

- Proof of income, such as pay stubs or tax returns.

- A list of current debts to be consolidated.

- Credit report to demonstrate creditworthiness.

Comparison of Requirements from Different Lenders

| Lender | Credit Score Requirement | Income Verification | Additional Documentation |

|---|---|---|---|

| Lender A | 600 | Pay stubs or tax returns | List of debts |

| Lender B | 650 | Bank statements | Credit report |

| Lender C | 700 | Employment verification | Proof of assets |

Types of Consolidation Loans

Consolidation loans come in various forms to cater to different financial needs and situations. Understanding the types of consolidation loans available can help individuals make informed decisions when seeking to consolidate their debts.

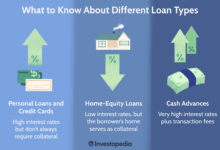

Secured vs. Unsecured Consolidation Loans

Secured consolidation loans require collateral, such as a home or a car, to secure the loan. This collateral serves as a guarantee for the lender, reducing their risk. On the other hand, unsecured consolidation loans do not require collateral but may have higher interest rates to compensate for the increased risk to the lender.

Federal Student Loan Consolidation vs. Private Consolidation Loans

Federal student loan consolidation is offered by the government and combines multiple federal student loans into a single loan with a fixed interest rate. This can simplify the repayment process and potentially lower monthly payments. Private consolidation loans, on the other hand, are offered by private lenders and can be used to consolidate both federal and private student loans. Private consolidation loans may offer different terms and interest rates compared to federal consolidation loans.

Specialized Consolidation Loans

There are specialized consolidation loans available for specific types of debt, such as credit card debt or medical bills. These loans are designed to help individuals manage and pay off specific types of debt more effectively. For example, a credit card consolidation loan may offer a lower interest rate compared to carrying balances on multiple credit cards, making it easier to pay off the debt over time.

Consolidation Loan Process

When it comes to applying for and receiving a consolidation loan, there are several steps involved in the process. Below is a breakdown of the step-by-step procedure, tips on selecting the right lender, and what to expect after approval and disbursement.

Applying for a Consolidation Loan

- Start by researching and comparing different lenders offering consolidation loans to find the best terms and interest rates.

- Gather all necessary documents, such as proof of income, credit reports, and information on your existing debts.

- Fill out the application form provided by the chosen lender, ensuring all information is accurate and up-to-date.

- Submit the application along with the required documents for the lender to review and assess your eligibility.

Choosing the Right Lender

- Consider the interest rates offered by different lenders and choose the one that provides the most competitive rates.

- Look into the reputation and customer reviews of the lender to ensure they are reliable and trustworthy.

- Check for any additional fees or charges associated with the loan to avoid any hidden costs.

- Review the terms and conditions of the loan carefully before signing any agreements to fully understand the repayment terms.

After Loan Approval and Disbursement

- Once your consolidation loan is approved, the lender will provide you with the details of the loan agreement, including the amount borrowed, interest rate, and repayment schedule.

- The lender will disburse the loan amount to pay off your existing debts, consolidating them into a single monthly payment.

- It is important to make timely payments on your consolidation loan to avoid any negative impact on your credit score and benefit from the debt consolidation process.

Alternatives to Consolidation Loans

When looking to manage debt, consolidation loans may not always be the best option. Exploring alternative debt relief solutions can help you make an informed decision based on your financial situation and goals.

Debt Settlement

Debt settlement involves negotiating with creditors to settle your debts for less than what you owe. While it can help reduce your overall debt burden, it may have a negative impact on your credit score and require you to pay taxes on the forgiven amount.

Bankruptcy

Bankruptcy is a legal process that can help you eliminate or restructure your debts. While it provides a fresh start, it can have long-term consequences on your credit score and financial future. It should be considered as a last resort due to its serious implications.

Debt Management Plan

A debt management plan involves working with a credit counseling agency to create a repayment plan that fits your budget. This option can help you consolidate your debts into one monthly payment with reduced interest rates, but it may not lower the total amount you owe.

Final Thoughts

In conclusion, consolidation loans provide a valuable tool for individuals looking to streamline their debt repayment process. By weighing the pros and cons, understanding eligibility criteria, and exploring alternatives, borrowers can make informed decisions to achieve financial stability.